5 keys to successfully investing in property in Costa Blanca and maximising the returns you could obtain.

The Costa Blanca property market has benefited from coronavirus. Far from the financial shock felt by other sectors, Costa Blanca has become an increasingly sought-after haven and is experiencing one of its sweetest moments.

In addition to the rise in property prices, there has also been an increase in the number of transactions as rarely seen in the past. Tourism is a major financial driver in this region and that is reflected in the area’s real estate market.

So, how do we invest in Costa Blanca to ensure that our operation is a success? What factors should we take into account to increase our profitability? In our Seller’s Guide, you will find all the keys to investing in Costa Blanca through sales.

<< Selling a property on the Costa Blanca [Free guide] >>

Keys to investing in Costa Blanca

In addition to our Guide, here are some of the keys that you should take into account to increase your chances of achieving maximum profitability with your real estate transaction.

Location

The very first thing to do is to decide on the municipality in which you are going to invest. If your main aim is to maximise the profitability of your real estate operation, you should leave more emotional aspects to one side and focus solely on objective factors to choose a town: revaluation index, demand, purchase prices, sale prices, rental prices… a real estate agency specialising in this type of transaction such as Hispania Homes will be able to help you in this process.

Once you’ve chosen the town, you will have to focus on the specific location of the property within the municipality. A flat on the seafront is not the same as one in an inland location. We’re not saying that one or the other is a better investment, it will all depend on the final purpose of the property in question.

You should study the orientation, the views and the surroundings: what infrastructures are nearby, parks, shops, leisure areas…

Villa with sea views in El Portet de Moraira Ref. 2204V

Purchase price

The purchase price will greatly influence the return we can obtain when investing in Costa Blanca.

The price at which properties are advertised on real estate portals is often inflated. Many times, these are advertisements by private individuals who do not know the real estate market in the area and are guided more by the profit they want to make than by what their property is really worth.

To find out a property’s optimum selling price, one must turn to real estate professionals. They are the only ones who, always after a market study, will be able to advise us on whether the price of the property we want to buy is in line with the reality of the market. If this is not the case, real estate professionals are perfectly qualified to negotiate with the seller to obtain a realistic purchase price that is in line with the property’s characteristics.

<< I want to know a property’s realistic price>>

Profitability

To get an idea of the returns you can expect when investing in Costa Blanca, you should pay close attention to the purchase prices of the properties, but also to rental prices and the revaluation trend.

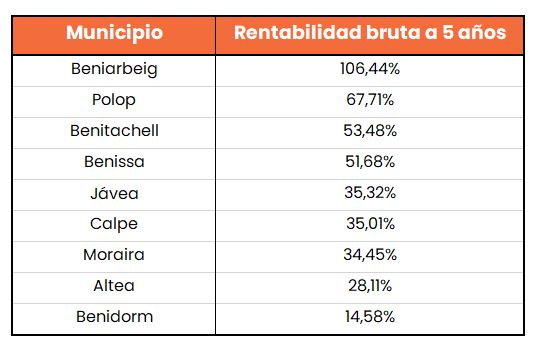

In our post ‘The most profitable municipalities in Costa Blanca‘ we have reviewed the average returns obtained by means of buying to sell in the Costa Blanca municipalities in which Hispania Homes operates.

Ranking of profitability in the municipalities in Costa Blanca in which Hispania Homes operates.

However, if you’re looking to invest in a rental property, we recommend that you take a look at the average price advertised by the real estate portals in each area.

Keep in mind that real estate portals only give information on advertised sales prices, never on final closing prices. For a more accurate idea of the profitability you can expect with your real estate transaction, you should always consult experts in the sector.

Condition of the property

The condition the property is in also has an influence on the returns you can expect to obtain. If the property you’re buying needs to be renovated in order to attract buyers or tenants, you should factor in the price of this renovation to calculate the net profitability.

Normally, the money that can be saved by buying a property in poor condition is usually more than the money that will need to be spent on a renovation to bring it up to standard. However, that isn’t always the case. A study that also factors in possible renovation costs is key to avoiding ending up in a bottomless pit and losing part of our savings.

Fixed costs

The fixed costs will also be another aspect to take into account when assessing whether our investment in Costa Blanca is going to be profitable or not and to what extent. Examine the community fees, IBI, contributions to extra building expenses, small domestic repairs, a possible mortgage loan and its respective interest…

Although a property may seem cheap at first glance, the fixed costs can upset the profitability balance, especially when considering a long-term operation.

Do you want to invest in Costa Blanca and don’t know where to start? Do you want information on the most profitable towns or on the type of operation that suits you best? At Hispania Homes, we can help.

We leave you with our Guide to Selling in Costa Blanca so that you can start to learn the keys to a safe and profitable sale.