Find out the taxes you will have to pay if you are a non-resident and decide to sell a property in Costa Blanca.

The real estate market is continuing to recover from the Covid-19 hiatus and is returning to figures similar to those registered before the pandemic. Foreign buyers and sellers have played a key role in this reactivation, and have become key players in this recovery, especially in Costa Blanca.

According to the General Board of Notaries, transactions involving foreigners increased by 41.9% in the second half of 2021 compared to the previous period. Although it is true that this increase is very much conditioned by the abrupt drops registered in the second half of 2020, the increase in this type of transaction is once again reaching figures similar to those seen in the months prior to the pandemic.

Specifically, and according to the same source of information, 18.6% of the sales and purchases registered in Spain during the second quarter of 2021 involved non-resident buyers, a percentage very similar to previous periods.

But what taxes do non-residents face when buying a property? What about when selling? We will now take a closer look at the taxes for non-residents upon selling a property in Costa Blanca.

Taxes on sales for non-residents

As is the case with buying, Spain does not impose any restrictions on the sale of property by non-resident owners. However, there are differences in the process, for instance, when it comes to paying taxes. The taxes for non-residents when selling a property in Costa Blanca are as follows:

Municipal Capital Gains (Plusvalía Municipal)

Municipal Capital Gains Tax (Plusvalía Municipal) for non-residents is levied on the increase in value of a property during the time it has been owned by the seller. It is a municipal tax, so the collecting entity will be the Council of the town where the property to be sold is located: Moraira, Altea, Calpe…

Municipal Capital Gains Tax must be paid by the seller, regardless of whether they are resident or non-resident. However, it should be taken into account that in the first case, the buyer or the buyer’s representative (real estate agency, lawyer…) may withhold the amount corresponding to the capital gains tax from the seller in order to ensure that it will be paid.

This is also the case for other taxes such as real estate tax (IBI) or urban waste tax.

Non-Resident Income Tax (IRNR)

Regardless of their place of residence, all sellers must declare the proceeds from the sale of their property to the Spanish Tax Agency.

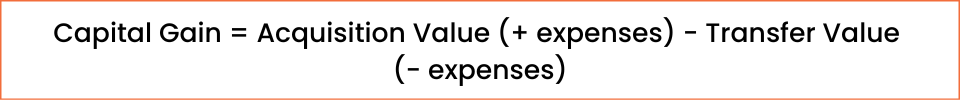

Non-Resident Income Tax is calculated on the difference between the transfer value and the acquisition value of the property, with each of these values being understood as the following concepts:

- Acquisition value: the price for which the property was acquired plus the expenses inherent to the acquisition (notary, administrative fees, lawyers, etc.), plus the expenses for investments and improvements and minus the tax-deductible value if the property was rented at any point in time.

- Transfer value: price at which the property will be sold unless the new cadastral reference value for the property is higher. The costs associated with the sale (notary, estate agent, etc.) may be deducted from this value.

Once the capital gain has been calculated, a rate of 19% will be applied for residents of the EU, Iceland or Norway ( as of 2016) and 24% for the rest.

Important!

As of 2015, citizens of the European Union, Iceland and Norway can exclude profits from property sales from this tax provided that the full amount of the profit is invested in the purchase of a primary residence in their country of residence.

If you want an estimate of the transfer price that you could obtain when selling your property, you can make use of Hispania Homes’ property valuation tool, a valuation tool that works with data based on properties sold in your area, together with our experience as a real estate agency in Costa Blanca.

<< I want to know the value of my property >>

3% retention

The 3% retention is one of the peculiarities of taxes for non-residents when selling a property in Costa Blanca. It is a retention on the price that the seller receives from the buyer at the time of the sale and it arises from the Non-Resident Income Tax.

This retention must be made by the buyer or their representative (a real estate agency, for example) and is made because non-residents are often unaware of their tax obligations and therefore fail to pay Non-residents’ Income Tax. As the Tax Agency often has difficulty in locating people who are not permanent residents in Spain, 3% of the sale price is withheld from them as a preventive measure so that taxes can be duly collected.

- If the seller has to pay less than 3% to the Tax Agency: they must file form 210 to claim back the difference.

- If the seller has to pay more than 3% to the Tax Agency: they will have to pay the difference.

*Selling a property on the Costa Blanca is not an easy task, especially when the seller is a non-resident who is unfamiliar with the process, tax obligations and sometimes even the language. At Hispania Homes, we have a multicultural and welcoming team that will guide you through the sale process from start to finish. If you need advice on the sale process, don’t hesitate to contact us.

Here is a Guide to selling in Costa Blanca to help you learn a little more about the sale process from a practical and above all professional perspective.