We show you how to calculate the Municipal Capital Gains Tax to be paid in Jávea and we offer you an Excel Template so that you can automatically calculate the Municipal Capital Gains Tax for your property yourself.

One of the expenses we face when we sell property is the Municipal Capital Gains Tax, a tax that is levied on the increase in value of urban land and which, following the latest changes in regulations, we will only be obliged to pay if we have obtained a real capital gain on the sale of our property.

In this article, we explain how to calculate the Municipal Capital Gains Tax to be paid in Jávea step by step and we provide you with an Excel Template that you can download and fill in with the details of your property to automatically calculate what you will have to pay for the Capital Gains Tax on your property.

Download Capital Gains Calculator

Municipal Capital Gains Tax for Moraira-Teulada, Benissa and Jávea

Access the Excel template with which you can automatically calculate the Municipal Capital Gains Tax for your property in Moraira

Changes to Municipal Capital Gains Tax

After the Constitutional Court declared the part of the article of the Amended Text of the Local Treasury Law regulating the calculation of this tax to be unconstitutional and null and void, the Council of Ministers approved Royal Decree-Law 26/2021, of 8 November, which introduced various changes to the levying of this tax:

- Two methods of calculating the rate were established which the taxpayer can choose between in order to pay the Municipal Capital Gains Tax: Actual Capital Gains and Objective Method.

- Taxpayers who have not made a real capital gain on the transfer of their property are not obliged to pay this tax.

- Capital gains generated in less than one year are taxable.

How to calculate the Municipal Capital Gains Tax to be paid in Jávea

Below we explain each of the calculation methods set out in the Royal Decree so that you can determine which is the most beneficial method for you to use to pay the tax.

Capital Gains Tax in Jávea: Objective Method

One of the systems you can opt for when calculating the Municipal Capital Gains Tax in Jávea is the Objective Method, a process that takes into account the number of years that have passed between the acquisition of the property and its transfer in order to calculate the tax. To find out what you will have to pay for the Capital Gains Tax on your property in Jávea if you opt for this method, you will have to follow these steps:

1st Calculate the Taxable Base

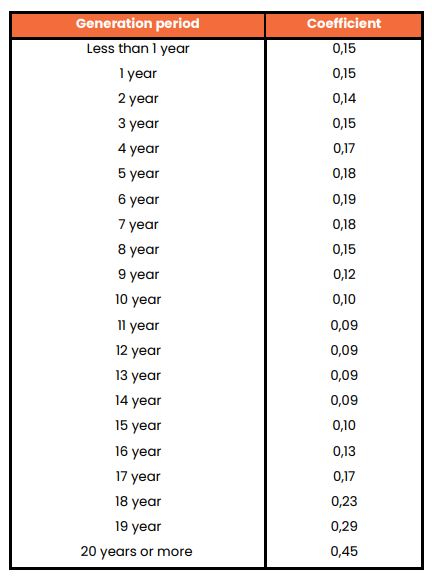

The first step is to apply the corresponding multiplication coefficient to the cadastral value of the land according to the number of years we have been in possession of the property, following the table below:

Let’s imagine that we bought a house 10 years ago with a cadastral value of the land of 60,000 euros. According to the table provided, the multiplication coefficient to be applied for that period is 0.10. Therefore, to calculate the Taxable Base we will have to multiply the value of the land (60,000 euros) by 0.10 (multiplication coefficient), obtaining a result of 6,000 euros.

2nd Apply the Tax Rate

Next, we will have to apply the Tax Rate established, in this case, by Jávea Council (i.e. 30%) to the Taxable Base.

Continuing with our example, we will have to apply a Tax Rate of 30% to the 6,000 euros (Taxable Base), resulting in a Tax Amount of 1,800 euros. We can then apply any relevant reductions (if any) that Jávea Council contemplates for our case to this figure.

Capital Gains Tax in Jávea: Actual Capital Gains

The second system available to us to calculate the Municipal Capital Gains on a property in Jávea is the Actual Capital Gain, a method that rather than taking into account the years that have passed between the acquisition and the transfer, is based on the actual Capital Gain obtained with our real estate transaction. In this case, the steps to follow would be as follows:

1st Calculate the Capital Gain

We start by calculating the actual capital gain of our transaction. To do this, we subtract the value at which we purchased our property from the value at which we are transferring it.

Continuing with the example we used in the Objective Method, let’s imagine that we bought the property for 95,000 euros and now we are going to sell it for 130,000 euros. In this case, the Capital Gain obtained from our sale is 35,000 euros.

2nd Calculate the Taxable Base

The next step is to obtain the Taxable Base by multiplying the Capital Gain obtained in step 1 by the percentage that the cadastral value of the land represents of the total cadastral value of the property.

If we take into account that the percentage that the cadastral value of the land represents in our sale is 50%, to continue with our example we will have to multiply the 35,000 euros of the Capital Gain by 50%, obtaining a Taxable Base of 17,500 euros.

3rd Apply the Tax Rate

Finally, all that remains is to apply the Tax Rate established by Jávea Council (30%) to the Taxable Base from the previous step.

In our example, the final stage of the calculation would be to apply 30% (Tax Rate) to the 17,500 euros (Taxable Base) to obtain a Tax Amount of 5,250 euros. We can then apply any relevant reductions (if any) that Jávea Council contemplates for our case to this figure.

Important*

In the examples seen in this article, the most advantageous method for presenting the Municipal Capital Gains Tax is the Objective Method, however, this is not always the case. It all depends on the time that has gone by between the acquisition and the transfer of the property and the capital gain obtained from the transaction.

*We remind you that at Hispania Homes we have made available an Excel Template that you can use to automatically calculate the Municipal Capital Gains Tax on a property in Jávea. Download your Excel Template and work out how much you will have to pay when you sell.